Table of Content

Depending on the circumstances, Freddie Mac requires a score of 620 or 660 for a single-family primary residence. If you are a veteran or an active military member, you are eligible for a flexible, low-cost VA loan. These are known as non-conforming loans, meaning they are designed to be held by the lending institution for the duration of the contract and will not be transferred to another financial institution.

The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. Refinance disclosure - By refinancing the existing loan, the total finance charges may be higher over the life of the loan. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

When Does A Conventional Loan Make More Sense For You?

Appraisal fees for conventional loans are usually lower, typically ranging from $300 – $400 for a single-family home versus $425 – $875 for a VA appraisal. It’s important to note that appraisal fees for a home being financed with any loan can cost north of $600 or even $2,000 depending on where you live, how big your house is, etc. However, depending on your financial situation and real estate goals, conventional loans may offer numerous advantages. Let’s explore these two mortgages in more detail to help you decide which one better fits your needs as a borrower.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Upfront MIP of 1.75% of the amount borrowed and monthly MIP number usually are required. But a funding percentage, a single-date fees ranging from as much as step one.25% and you will step 3.6% of your loan amount, is needed. If you are searching for a mortgage, make sure to comprehend the difference in a normal, FHA-insured, and you may Va-protected loan. Annual MIP is equal to between 0.45 – 1.05% of the loan amount, depending on the loan term, amount borrowed and the size of your down payment.

Comparing Conventional, FHA and VA Loans

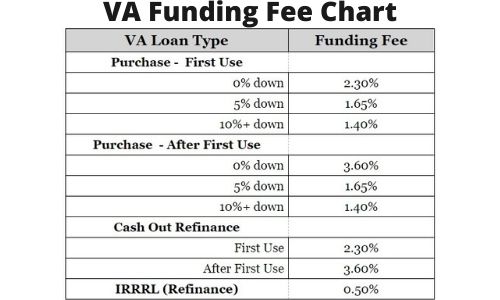

Borrowers who aren't VA-eligible can do well with a conventional loan that's selected to meet their needs. The VA funding fee is a one-time governmental fee that is applied to any VA-backed home loan. While VA loans are available throughout the country, each state has its own set of eligibility standards to qualify. Factors such as your length of service, duty status and character of service can all affect your eligibility to qualify for a specific VA loan. While the differences between the two are clear on paper, it remains ambiguous if one option is definitively better than the other. In this guide, we dive deeper into the key differences between these popular loans and share tips to help you select the best option for your unique home buying situation.

That’s partially due to the lack of a minimum down payment requirement. Conforming loan, conventional loans tend to be more common, with a relatively standardized process. Additionally, since lenders can offload the mortgage and its potential risk to mortgage buyers, they’re usually cheaper than non-conforming loans. Conventional loans are conforming loans, which means they meet the guidelines to be sold to mortgage buyers such as Freddie Mac and Fannie Mae. An exception is a jumbo loan, which is a conventional home loan that’s considered non-conforming – instead of conforming – because it exceeds the loan limits set by Fannie Mae and Freddie Mac.

Loan Officer Email Form

For conventional loans, most lenders will require you to put at least 3% of the purchase price down, depending on your financial situation and credit score. However, if you make a down payment of at least 20%, you can also forgo paying private mortgage insurance from the beginning of your loan term. There are no hard-and-fast credit score requirements for VA or conventional loans. But if you’re looking at these loan types, you should plan to have a score of at least 620 to qualify. An excellent credit score for a conventional loanis 740.

Conventional loans feature no government guarantees and adhere to the standards and requirements of government-sponsored enterprises Fannie Mae and Freddie Mac. Talk with a home loan specialist to get a complete comparison for your unique homebuying journey. Here are the factors to consider when deciding between a Department of Veterans Affairs mortgage and a conventional loan. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

VA Loan Vs. Conventional Loan: Credit Score

For folks who default into loan, the borrowed funds insurer ensures the lender is actually paid-in complete. FHA also provides refinance choices, for example an improve refinance. So you’re able to refinance, you must qualify for often brand new FHA-insured mortgage and other financing type.

LoanDepot’s powerful savings tool will assess your options instantly. LoanDepot’s easy-to-use calculator puts you in charge of estimating your mortgage payment. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear.

Private lenders that handle VA loans are guaranteed specific terms from the VA. These loans usually have lenient terms for borrowers and do not require a down payment. The VA also caps closing costs, which – along with competitive interest rates – can make VA loans financially favorable. The PMI may be a one-time closing charge, a regular fee or premium added to your monthly payment, or a combination of the two. In comparison, a conventional mortgage may allow you to qualify with a DTI as high as 50%. However, lenders may prefer borrowers with a lower ratio.

VA loans and conventional loans are just two options that qualifying borrowers can use to finance a home purchase. Before unpacking the differences between these types of home loans, let’s first get a little more acquainted with the basics of these loan programs. If you are eligible, a VA loan is often better than a conventional loan. You can buy a home with no down payment, a higher debt-to-income ratio, and no private mortgage insurance.

Consider your finances, needs, preferences and what you can qualify for when you’re weighing the pros and cons between a conventional vs. FHA vs. VA loan. If you qualify, conventional mortgages generally pose fewer hurdles than FHA or VA mortgages, which might take longer to process. A key differentiator between conventional vs. FHA loans is that a conventional loan has a higher credit score requirement than an FHA loan. FHA loans are generally a better fit for borrowers with lower scores. Bankrate.com is an independent, advertising-supported publisher and comparison service.

No comments:

Post a Comment